信用评分卡 (part 1 of 7)

python信用评分卡(附代码,博主录制)

信用危机时代的信用评分卡

Credit Scorecards in the Age of Credit Crisis

This incident took place at a friend’s party circa 2009, in the backdrop of the worst financial crisis the planet has seen for a long time. The average Joe on the street was aware of terms such as mortgaged-backed securities (MBS), sub-prime lending and credit crisis – the reasons for his plight. Back to our party, I met an informed & compassionate elderly woman and after a few minutes of chitchat, the topic came to what I do for a living. At that point, I was working on a project of developing credit-scorecard for a leading mortgage lender in Mumbai. As I started explaining the details of my job, her expression changed from curious to angst and pain. Eventually, she interrupted and said – why would you do such a thing? Is this not the reason for all the mess? I was used to this reaction and had to correct her misconception.

信用危机时代的信用记分卡

这一事件发生在大约2009年的朋友聚会上,在这个星球长期以来最严重的金融危机背景下。 街上的乔普通知道抵押贷款支持证券(MBS),次级贷款和信贷危机等条款 - 这是他困境的原因。 回到我们的聚会上,我遇到了一位知情和富有同情心的老年妇女,经过几分钟的闲聊,这个主题来到了我的生活。 那时,我正在为孟买一家领先的抵押贷款机构开发一个信用记分卡项目。 当我开始解释我的工作细节时,她的表情从好奇变为焦虑和痛苦。 最后,她打断了她说 - 你为什么要做这样的事? 这不是所有混乱的原因吗? 我习惯了这种反应,不得不纠正她的误解。

Predictive Analytics: The lurking Danger – by Roopam

Credit or application scorecards can be excellent tools for both lender and borrower to work out debt serving capability of the borrower. For lenders, scorecards can help them assess the creditworthiness of the borrower and maintain a healthy portfolio – which will eventually influence the economy as a whole. Additionally to the borrower, they can provide valuable information such as 45% of people with her socio-economic background have struggled to keep up with the EMI commitment. This could help the borrower make a well-informed decision before getting into a debt trap. Blaming science for reckless human behavior is not new. I believe, any rigorous science with practical applications is like a sharp German blade, a master chef prepares delicious meals with it and the irresponsible leaves a deep and painful cut.

信用卡或应用程序记分卡可以成为贷款人和借款人计算借款人偿债能力的绝佳工具。 对于贷方而言,记分卡可以帮助他们评估借款人的信誉并维持健康的投资组合 - 这最终将影响整个经济。 除借款人外,他们还可以提供有价值的信息,例如45%具有社会经济背景的人都在努力跟上EMI的承诺。 这可以帮助借款人在陷入债务陷阱之前做出明智的决定。 为鲁莽的人类行为指责科学并不新鲜。 我相信,任何具有实际应用的严谨科学就像一把锋利的德国刀片,一位大厨用它准备可口的饭菜,而不负责任的会留下深刻而痛苦的切口。

Scorecards and Predictive Analytics

In the following series, we will explore the practitioners’ approach for developing and maintaining a scorecard. At a very high-level, credit scorecards have their roots in the classification problem in statistics & data mining. The classification problems present an extremely broad methodology/thought-process that has multiple business applications. A few applications for classification problem are:

• Application or credit scorecards to assess repayment risk of the borrower

• Image analytics of MRI to identify if the cancer is benevolent or malignant

• Behavioral models to identify the most probable future action of the customer

• Identification of potential drug targets in the protein structure

• Fraud detection models

• Sentiment analysis of Tweets and Facebook posts

• Cross/up sell propensity models

• Campaign response models

• Insurance ratings

在下面的系列中,我们将探讨从业者开发和维护记分卡的方法。 在非常高的层次上,信用记分卡的根源在于统计和数据挖掘中的分类问题。 分类问题提供了一个极其广泛的方法/思维过程,具有多个业务应用程序。 一些分类问题的应用是:

•应用程序或信用记分卡,用于评估借款人的还款风险

•MRI的图像分析,以确定癌症是仁慈的还是恶性的

•行为模型,用于识别客户最可能的未来行为

•鉴定蛋白质结构中的潜在药物靶标

•欺诈检测模型

•推文和Facebook帖子的情绪分析

•交叉/向上销售倾向模型

•活动响应模型

•保险评级

For that matter, there are subtle links between credit scorecards and other models mentioned above. The details of these models could be drastically different but the underlining idea for these models is linked to the classification problem. In this series, I shall focus on credit or application scorecard methodology but will try to bring in other another scorecards and models whenever possible.

就此而言,信用记分卡与上述其他模型之间存在微妙的联系。 这些模型的细节可能截然不同,但这些模型的强调理念与分类问题有关。 在本系列中,我将重点介绍信用卡或应用记分卡方法,但会尝试尽可能引入其他记分卡和模型。

评分卡主要流程:

样本数据开发--模型开发--拒绝引用-评分卡制作和预测

Credit Scoring: Development Stages of Credit Scorecard – by Roopam

Flow of Subsequent Articles

The flow of subsequent articles in the series will be as following

1. Classification problem and sampling

2. Variable selection and coarse classing

3. Predictive Models

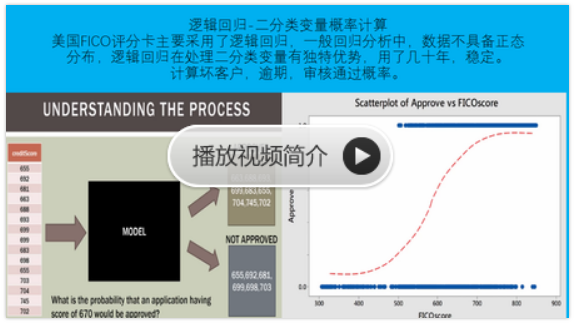

4. Logistic regression and scorecards

5. Model validation

6. Application and business process integration

后续文章的流程

该系列中后续文章的流程如下

1.分类问题和抽样

2.变量选择和粗略分类

3.预测模型

4.逻辑回归和记分卡

5.模型验证

6.应用程序和业务流程集成

Books for Credit Scorecards

I have compiled a list of books you may find useful while learning about analytical scorecards. The first four of these books have more or less the same flow, with Anderson’s book (#4) a little more detailed. However, you could choose any one of these four books without losing much .The last book (#5) is a collection of articles / papers by practitioners and academicians and is quite interesting.

信用记分卡的书籍

在编写分析记分卡时,我编制了一份您可能会发现有用的书籍清单。 这些书中的前四本或多或少都有相同的流程,而安德森的书(#4)更为详细。 但是,您可以选择这四本书中的任何一本,而不会损失太多。最后一本书(#5)是一组由从业者和学者组成的文章/论文,非常有趣。

1. Credit Risk Scorecards: Developing and Implementing Intelligent Credit Scoring – Naeem Siddiqi

2. Credit Scoring, Response Modeling, and Insurance Rating: A Practical Guide to Forecasting Consumer Behavior – Steven Finlay

3. Credit Scoring for Risk Managers: The Handbook for Lenders – Elizabeth Mays and Niall Lynas

4. The Credit Scoring Toolkit: Theory and Practice for Retail Credit Risk Management and Decision Automation – Raymond Anderson

5. Credit Risk Models – Elizabeth Mays

Sign-off Note

Look forward to sharing my views on predictive analytics and hearing back from you. See you soon with the second part of this series.

信用评分卡 (part 1 of 7)的更多相关文章

- 信用评分卡(A卡/B卡/C卡)的模型简介及开发流程|干货

https://blog.csdn.net/varyall/article/details/81173326 如今在银行.消费金融公司等各种贷款业务机构,普遍使用信用评分,对客户实行打分制,以期对客户 ...

- 信用评分卡 (part 7 of 7)

python信用评分卡(附代码,博主录制) https://study.163.com/course/introduction.htm?courseId=1005214003&utm_camp ...

- 信用评分卡 (part 6 of 7)

python信用评分卡(附代码,博主录制) https://study.163.com/course/introduction.htm?courseId=1005214003&utm_camp ...

- 信用评分卡 (part 5 of 7)

python信用评分卡(附代码,博主录制) https://study.163.com/course/introduction.htm?courseId=1005214003&utm_camp ...

- 信用评分卡 (part 4 of 7)

python信用评分卡(附代码,博主录制) https://study.163.com/course/introduction.htm?courseId=1005214003&utm_camp ...

- 信用评分卡 (part 3of 7)

python信用评分卡(附代码,博主录制) https://study.163.com/course/introduction.htm?courseId=1005214003&utm_camp ...

- 信用评分卡 (part 2of 7)

python信用评分卡(附代码,博主录制) https://study.163.com/course/introduction.htm?courseId=1005214003&utm_camp ...

- 信用评分卡Credit Scorecards (1-7)

欢迎关注博主主页,学习python视频资源,还有大量免费python经典文章 python风控评分卡建模和风控常识 https://study.163.com/course/introductio ...

- python德国信用评分卡建模(附代码AAA推荐)

欢迎关注博主主页,学习python视频资源,还有大量免费python经典文章 python信用评分卡建模视频系列教程(附代码) 博主录制 https://study.163.com/course/i ...

随机推荐

- if 结构语句

if 条件: print()#不只是能输入print

- Nginx 决策浏览器缓存是否有效

expires指令是告诉浏览器过期时间 syntax:expires [modified] time; eopch | max | off; default : off context :http,s ...

- linq之group by 的使用

group by var list = from s in _sysBll.GetList(s => s.ParamID == "TraSchType" && ...

- 洛谷P1057传球游戏题解

题目 这个题表面上看并不像DP,但是当我们看到方案数时,我们可能会想到什么??? 对,分类加法原理,在每一轮中,每一个点的方案数都要加上这个点左边的方案与右边的方案. 因此我们可以枚举,设一个DP数组 ...

- alter table,复制, 单表查询

修改表 语法:1. 修改表名 ALTER TABLE 表名 RENAME 新表名; 2. 增加字段 ALTER TABLE 表名 ...

- Codeforces555 B. Case of Fugitive

Codeforces题号:#310B 出处: Codeforces 主要算法:贪心+优先队列 难度:4.6 思路分析: 这道题乍一看没有思路…… 考虑贪心的做法.首先预处理出每两座相邻的桥之间边界相差 ...

- NORMA2 - Norma [cdq分治]

题面 洛谷 你有一个长度为n的序列,定义这个序列中每个区间的价值是 \(Cost(i,j)=Min(Ai...Aj)∗Max(Ai...Aj)∗(j−i+1)Cost(i,j)=Min(A_{i}.. ...

- 【UOJ#422】【集训队作业2018】小Z的礼物(min-max容斥,轮廓线dp)

[UOJ#422][集训队作业2018]小Z的礼物(min-max容斥,轮廓线dp) 题面 UOJ 题解 毒瘤xzy,怎么能搬这种题当做WC模拟题QwQ 一开始开错题了,根本就不会做. 后来发现是每次 ...

- 【转】c语言中的#号和##号的作用

@2019-01-25 [小记] c语言中的#号和##号的作用

- 「SHOI2016」黑暗前的幻想乡 解题报告

「SHOI2016」黑暗前的幻想乡 sb题想不出来,应该去思考原因,而不是自暴自弃 一开始总是想着对子树做dp,但是状态压不起去,考虑用容斥消减一些条件变得好统计,结果越想越乱. 期间想过矩阵树定理, ...