QuantLib 金融计算——收益率曲线之构建曲线(4)

如果未做特别说明,文中的程序都是 C++11 代码。

QuantLib 金融计算——收益率曲线之构建曲线(4)

本文代码对应的 QuantLib 版本是 1.15。相关源代码可以在 QuantLibEx 找到。

概述

QuantLib 中提供了用三次 B 样条函数拟合期限结构的功能,但是,并未提供使用三次样条函数拟合期限结构的功能。本文展示了如何在 QuantLib 的框架内实现三次样条函数,并拟合期限结构。

示例所用的样本券交易数据来自专门进行期限结构分析的 R 包——termstrc。具体来说是数据集 govbonds 中的 GERMANY 部分,包含 2008-01-30 这一天德国市场上 52 只固息债的成交数据。

注意:为了适配 QuantLib,实际计算中删除了两只债券的数据,以保证所有样本券的到期时间均不相同。样本券数据在《收益率曲线之构建曲线(3)》的附录中列出。

三次样条函数与期限结构

用三次样条函数拟合期限结构,实质上是用若干三次样条函数的组合近似贴现因子曲线的形状,

\]

贴现因子 \(d(t,\beta)\) 表示为三次样条函数的线性组合,\(\beta_l\) 是最优化计算需要估计出的参数。

三次样条函数 \(c_l(t)\) 的形式基于文献 (Ferstl and Hayden, 2010),

& \text{ if } l=n, c_l(t)=t\\

& \text{ else }, c_{l}\left(t\right)=

\left\{\begin{array}{ll}

0 & {t<k_{l-1}} \\

{\frac{\left(t-k_{l-1}\right)^{3}}{6\left(k_{l}-k_{l-1}\right)}} & {k_{l-1} \leq t<k_{l}} \\

{\frac{\left(k_{l}-k_{l-1}\right)^{2}}{6}+\frac{\left(k_{l}-k_{l-1}\right)\left(t-k_{l}\right)}{2}+\frac{(t-k_l)^2}{2} -\frac{\left(t-k_{l}\right)^{3}}{6\left(k_{l+1}-k_{l}\right)}} & {k_{l} \leq t<k_{l+1}} \\

{\left(k_{l+1}-k_{l-1}\right)\left[\frac{2 k_{l+1}-k_{l}-k_{l-1}}{6}+\frac{t-k_{l+1}}{2}\right]} & {k_{l+1} \leq t}

\end{array}\right.

\end{cases}

\]

对于有 \(n\) 个参数的贴现因子曲线,用户需要提供 \(n-1\) 个 knots \(k_i(1\le i\lt n)\),并令 \(k_0 = 0\) 以及 \(k_n = k_{n-1}\)。

knots 的选择

knots 的选择基于文献 (McCulloch, 1975),也可以参考文献 (Ferstl and Hayden, 2010),

& \text{ if } l=1, k_l = 0\\

& \text{ else if } l=n-1,k_l=m_N \\

& \text{ else }, k_l = m_h + \theta(m_{h+1} - m_h)

\end{cases}

\]

其中,\(h=\left\lceil\frac{(l-1) k}{n-2}\right\rceil\),\(\theta=\frac{(l-1) k}{n-2}-h\),\(n = \left\lfloor\sqrt{k}+0.5 \right\rfloor\),\(m_i(1 \le i\le N)\) 是升序排列后样本券的剩余期限。

实现三次样条函数

三次样条函数类 CubicSpline 的实现仿照已存在的 BSpline 类,

CubicSpline.hpp

class CubicSpline {

public:

CubicSpline(const std::vector<Real>& knots);

~CubicSpline();

Real operator()(Natural i, Real x) const;

private:

Size n_;

std::vector<Real> knots_ex_;

};

CubicSpline.cpp

CubicSpline::CubicSpline(const std::vector<Real>& knots)

: n_(knots.size() + 1), knots_ex_(knots) {

knots_ex_.insert(knots_ex_.begin(), 0.0);

knots_ex_.insert(knots_ex_.end(), knots.back());

}

CubicSpline::~CubicSpline() {

}

Real CubicSpline::operator()(Natural i, Real x) const {

using namespace std;

if (i < n_) {

Real q = knots_ex_[i], q_minus = knots_ex_[i - 1], q_plus = knots_ex_[i + 1];

if (x < q_minus) {

return 0.0;

} else if (q_minus <= x and x < q) {

return pow(x - q_minus, 3) / (6.0 * (q - q_minus));

} else if (q <= x and x < q_plus) {

return pow(q - q_minus, 2) / 6.0

+ (q - q_minus) * (x - q) / 2.0

+ pow(x - q, 2) / 2.0

- pow(x - q, 3) / (6.0 * (q_plus - q));

} else {

return (q_plus - q_minus)

* ((2.0 * q_plus - q - q_minus) / 6.0

+ (x - q_plus) / 2.0);

}

} else {

return x;

}

}

实现拟合方法

拟合方法 CubicSplinesFitting 的实现仿照已存在的 CubicBSplinesFitting 类,两者均是 FittedBondDiscountCurve::FittingMethod 的派生类,

CubicSplinesFitting.hpp

class CubicSplinesFitting

: public FittedBondDiscountCurve::FittingMethod {

public:

CubicSplinesFitting(const std::vector<Time>& knotVector,

const Array& weights = Array(),

ext::shared_ptr<OptimizationMethod>

optimizationMethod = ext::shared_ptr<OptimizationMethod>(),

const Array& l2 = Array());

CubicSplinesFitting(const std::vector<Time>& knotVector,

const Array& weights,

const Array& l2);

//! cubic spline basis functions

Real basisFunction(Integer i, Time t) const;

static std::vector<Time> autoKnots(const std::vector<Time>& maturities);

#if defined(QL_USE_STD_UNIQUE_PTR)

std::unique_ptr<FittedBondDiscountCurve::FittingMethod> clone() const;

#else

std::auto_ptr<FittedBondDiscountCurve::FittingMethod> clone() const;

#endif

private:

Size size() const;

DiscountFactor discountFunction(const Array& x, Time t) const;

CubicSpline splines_;

Size size_;

//! N_th basis function coefficient to solve for when d(0)=1

Natural N_;

};

CubicSplinesFitting.cpp

CubicSplinesFitting::CubicSplinesFitting(const std::vector<Time>& knots,

const Array& weights,

ext::shared_ptr<OptimizationMethod> optimizationMethod,

const Array& l2)

: FittedBondDiscountCurve::FittingMethod(

false, weights, optimizationMethod, l2),

splines_(knots) {

Size basisFunctions = knots.size() + 1;

size_ = basisFunctions;

N_ = 0;

}

CubicSplinesFitting::CubicSplinesFitting(const std::vector<Time>& knots,

const Array& weights,

const Array& l2)

: FittedBondDiscountCurve::FittingMethod(

false, weights, ext::shared_ptr<OptimizationMethod>(), l2),

splines_(knots) {

Size basisFunctions = knots.size() + 1;

size_ = basisFunctions;

N_ = 0;

}

Real CubicSplinesFitting::basisFunction(Integer i,

Time t) const {

return splines_(i, t);

}

QL_UNIQUE_OR_AUTO_PTR<FittedBondDiscountCurve::FittingMethod> CubicSplinesFitting::clone() const {

return QL_UNIQUE_OR_AUTO_PTR<FittedBondDiscountCurve::FittingMethod>(

new CubicSplinesFitting(*this));

}

Size CubicSplinesFitting::size() const {

return size_;

}

DiscountFactor CubicSplinesFitting::discountFunction(const Array& x,

Time t) const {

DiscountFactor d = 1.0;

for (Size i = 0; i < size_; ++i) {

d += x[i] * splines_(i + 1, t);

}

return d;

}

std::vector<Time> CubicSplinesFitting::autoKnots(const std::vector<Time>& maturities) {

using namespace std;

vector<Time> m(maturities);

sort(m.begin(), m.end());

Size k = m.size();

Size n(floor(sqrt(k) + 0.5));

vector<Time> knots(n - 1);

knots[0] = 0.0;

knots[n - 1] = m.back();

for (Size l = 1; l < n - 1; ++l) {

Size h(ceil(Real(l * k) / Real(n - 2)));

Real theta = Real(l * k) / Real(n - 2) - h;

knots[l] = m[h - 1] + theta * (m[h] - m[h - 1]);

}

return knots;

}

测试

用上述两个类拟合样本券的期限结构,并和 termstrc 的结果做比较。

辅助函数 CubicSplineSpotRate 用于将样条函数表示的贴现因子转换成即期利率。

QuantLib::Real CubicSplineSpotRate(const std::vector<QuantLib::Real>& knots,

const QuantLib::Array& weights,

const QuantLib::Time& t) {

using namespace std;

using namespace QuantLib;

CubicSpline spline(knots);

Size s = weights.size();

Real d = 1.0, r;

for (Size i = 0; i < s; ++i) {

d += weights[i] * spline(i + 1, t);

}

r = -std::log(d) / t;

return r;

}

测试函数

void TestCubicSplineFitting() {

using namespace std;

using namespace QuantLib;

// 样本券数据,以及相关配置

Size bondNum = 50;

vector<Real> cleanPrice = {

100.002, 99.92, 99.805, 99.75, 100.305, 99.76, 99.75, 99.975, 100.0416, 100.0574,

99.5049, 101.0971, 101.137, 100.7199, 99.8883, 100.908, 103.3553, 99.5034, 103.913, 97.4229,

104.5636, 99.7527, 104.3708, 99.6051, 104.8603, 101.3415, 105.29, 102.4969, 103.7602, 100.2803,

102.6046, 102.5291, 99.4748, 95.9702, 97.1815, 114.2849, 100.2847, 112.23, 98.397, 102.0235,

99.8483, 121.2711, 125.9157, 114.5791, 103.2202, 123.4668, 113.4694, 103.1873, 91.5603, 95.4441};

vector<Handle<Quote>> priceHandle(bondNum);

for (Size i = 0; i < bondNum; ++i) {

ext::shared_ptr<Quote> q(

new SimpleQuote(cleanPrice[i]));

Handle<Quote> hq(q);

priceHandle[i] = hq;

}

vector<Year> issueYear = {

2002, 2006, 2003, 2006, 1998, 2006, 2003, 2006, 1999, 2007,

2004, 2007, 1999, 2007, 2004, 2007, 1999, 2005, 2000, 2005,

2000, 2006, 2001, 2006, 2001, 2007, 2002, 2007, 2002, 2003,

2003, 2004, 2004, 2005, 2005, 1986, 2006, 1986, 2006, 2007,

2007, 1993, 1997, 1998, 1998, 2000, 2000, 2003, 2004, 2006};

vector<Month> issueMonth = {

Aug, Mar, Apr, May, Jul, Aug, Sep, Nov, Jan, Feb,

Feb, May, Jul, Aug, Aug, Sep, Oct, Feb, May, Aug,

Sep, Feb, May, Aug, Dec, Feb, Jun, Aug, Dec, Jun,

Oct, Apr, Oct, Apr, Oct, Jun, Apr, Sep, Oct, Apr,

Sep, Dec, Jul, Jan, Oct, Jan, Oct, Jan, Dec, Dec};

vector<Day> issueDay = {

14, 8, 11, 30, 4, 30, 25, 30, 4, 28, 2, 30, 4, 24, 25, 21, 22,

24, 5, 26, 29, 26, 23, 30, 28, 28, 26, 24, 31, 24, 21, 25, 27, 28,

30, 20, 26, 20, 31, 27, 21, 29, 3, 4, 7, 4, 27, 22, 24, 28};

vector<Year> maturityYear = {

2008, 2008, 2008, 2008, 2008, 2008, 2008, 2008, 2009, 2009,

2009, 2009, 2009, 2009, 2009, 2009, 2010, 2010, 2010, 2010,

2011, 2011, 2011, 2011, 2012, 2012, 2012, 2012, 2013, 2013,

2014, 2014, 2015, 2015, 2016, 2016, 2016, 2016, 2017, 2017,

2018, 2024, 2027, 2028, 2028, 2030, 2031, 2034, 2037, 2039};

vector<Month> maturityMonth = {

Feb, Mar, Apr, Jun, Jul, Sep, Oct, Dec, Jan, Mar,

Apr, Jun, Jul, Sep, Oct, Dec, Jan, Apr, Jul, Oct,

Jan, Apr, Jul, Oct, Jan, Apr, Jul, Oct, Jan, Jul,

Jan, Jul, Jan, Jul, Jan, Jun, Jul, Sep, Jan, Jul,

Jan, Jan, Jul, Jan, Jul, Jan, Jan, Jul, Jan, Jul};

vector<Day> maturityDay = {

15, 14, 11, 13, 4, 12, 10, 12, 4, 13, 17, 12, 4, 11, 9, 11,

4, 9, 4, 8, 4, 8, 4, 14, 4, 13, 4, 12, 4, 4, 4, 4, 4, 4, 4,

20, 4, 20, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4};

vector<Date> issueDate(bondNum), maturityDate(bondNum);

for (Size i = 0; i < bondNum; ++i) {

Date idate(issueDay[i], issueMonth[i], issueYear[i]);

Date mdate(maturityDay[i], maturityMonth[i], maturityYear[i]);

issueDate[i] = idate;

maturityDate[i] = mdate;

}

vector<Real> couponRate = {

0.0425, 0.03, 0.03, 0.0325, 0.0475, 0.035, 0.035, 0.0375, 0.0375, 0.0375,

0.0325, 0.045, 0.045, 0.04, 0.035, 0.04, 0.05375, 0.0325, 0.0525, 0.025,

0.0525, 0.035, 0.05, 0.035, 0.05, 0.04, 0.05, 0.0425, 0.045, 0.0375, 0.0425,

0.0425, 0.0375, 0.0325, 0.035, 0.06, 0.04, 0.05625, 0.0375, 0.0425, 0.04,

0.0625, 0.065, 0.05625, 0.0475, 0.0625, 0.055, 0.0475, 0.04, 0.0425};

Frequency frequency = Annual;

Actual365Fixed dayCounter(Actual365Fixed::Standard);

BusinessDayConvention paymentConv = Unadjusted;

BusinessDayConvention terminationDateConv = Unadjusted;

BusinessDayConvention convention = Unadjusted;

Real redemption = 100.0;

Real faceAmount = 100.0;

Germany calendar(Germany::Eurex);

Date today = calendar.adjust(Date(30, Jan, 2008));

Settings::instance().evaluationDate() = today;

Natural bondSettlementDays = 0;

Date bondSettlementDate = calendar.advance(

today,

Period(bondSettlementDays, Days));

vector<ext::shared_ptr<BondHelper>> instruments(bondNum);

vector<Time> maturity(bondNum);

// 配置 helper

for (Size i = 0; i < bondNum; ++i) {

vector<Real> bondCoupon = {couponRate[i]};

Schedule schedule(

issueDate[i],

maturityDate[i],

Period(frequency),

calendar,

convention,

terminationDateConv,

DateGeneration::Backward,

false);

ext::shared_ptr<FixedRateBondHelper> helper(

new FixedRateBondHelper(

priceHandle[i],

bondSettlementDays,

faceAmount,

schedule,

bondCoupon,

dayCounter,

paymentConv,

redemption));

maturity[i] = dayCounter.yearFraction(

bondSettlementDate, helper->maturityDate());

instruments[i] = helper;

}

Real tolerance = 1.0e-6;

Natural max = 5000;

ext::shared_ptr<OptimizationMethod> optMethod(

new LevenbergMarquardt());

vector<Real> knots = CubicSplinesFitting::autoKnots(maturity);

vector<Real> termstrcKnotes = {

0.000000, 1.006027, 2.380274, 5.033425, 9.234521, 31.446575};

cout << "QuantLib knots:\t";

for (auto v : knots) {

cout << setprecision(6) << fixed << v << ", ";

}

cout << endl;

cout << "termstrc knots:\t";

for (auto v : termstrcKnotes) {

cout << setprecision(6) << fixed << v << ", ";

}

cout << endl;

cout << endl;

CubicSplinesFitting csf(

knots, Array(), optMethod);

FittedBondDiscountCurve tsCubicSplines(

bondSettlementDate,

instruments, dayCounter,

csf, tolerance, max);

Array weights = tsCubicSplines.fitResults().solution();

Array termstrcWeights(7);

termstrcWeights[0] = 1.9320e-02, termstrcWeights[1] = -8.4936e-05,

termstrcWeights[2] = -3.2009e-04, termstrcWeights[3] = -3.7101e-04,

termstrcWeights[4] = 7.2921e-04, termstrcWeights[5] = 2.0159e-03,

termstrcWeights[6] = -4.1632e-02;

cout << "QuantLib weights: \t" << weights << endl;

cout << "termstrc weights: \t" << termstrcWeights << endl;

cout << endl;

cout << "QuantLib final cost value:\t"

<< tsCubicSplines.fitResults().minimumCostValue() << endl;

cout << endl;

// 比较 QuantLib 和 termstrc 的结果

Real spotRate, termstrcSpot;

for (Size i = 0; i < bondNum; ++i) {

Time t = dayCounter.yearFraction(

bondSettlementDate, maturityDate[i]);

spotRate =

tsCubicSplines.zeroRate(t, Compounding::Continuous, frequency).rate() * 100.0;

termstrcSpot =

CubicSplineSpotRate(termstrcKnotes, termstrcWeights, t) * 100.0;

cout << setprecision(3) << fixed

<< t << ",\t"

<< spotRate << ",\t"

<< termstrcSpot << ",\t"

<< spotRate - termstrcSpot << endl;

}

}

部分结果:

QuantLib knots: 0.000000, 1.117808, 2.690411, 5.430137, 9.432877, 31.446575,

termstrc knots: 0.000000, 1.006027, 2.380274, 5.033425, 9.234521, 31.446575,

QuantLib weights: [ 0.005281; 0.004565; -0.002934; 0.000804; 0.000652; 0.001886; -0.038316 ]

termstrc weights: [ 0.019320; -0.000085; -0.000320; -0.000371; 0.000729; 0.002016; -0.041632 ]

QuantLib final cost value: 0.000338

0.044, 3.823, 4.125, -0.302

0.121, 3.809, 4.061, -0.253

0.197, 3.794, 4.001, -0.207

0.370, 3.761, 3.878, -0.116

...

..

.

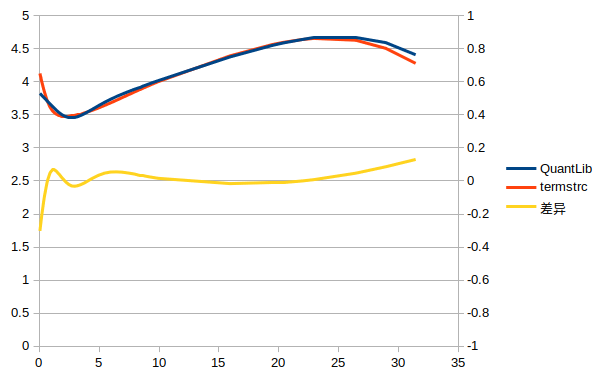

图 1:结果对比

注意:尽管以 termstrc 的结果作为基准,并不意味着基准就是正确答案。

由于样本券的数量不同(termstrc 使用了 52 只券),两者的 knots 差异较大。同时,因为优化方法的不同(termstrc 使用 OLS,QuantLib 使用 Levenberg-Marquardt 算法),估计出的参数也有差异。最终导致两个期限结构在两端差异较大。

不过,考虑到最终的 cost value,QuantLib 的结果可能更好一些。

参考文献

- Ferstl.R, Hayden.J (2010). "Zero-Coupon Yield Curve Estimation with the Package

termstrc." Journal of Statistical Software, Volume 36, Issue 1. - McCulloch JH (1975). "The Tax-Adjusted Yield Curve." The Journal of Finance, 30(3), 811–830.

QuantLib 金融计算——收益率曲线之构建曲线(4)的更多相关文章

- QuantLib 金融计算——收益率曲线之构建曲线(1)

目录 QuantLib 金融计算--收益率曲线之构建曲线(1) YieldTermStructure DiscountCurve DiscountCurve 对象的构造 ZeroCurve ZeroC ...

- QuantLib 金融计算——收益率曲线之构建曲线(2)

目录 QuantLib 金融计算--收益率曲线之构建曲线(2) YieldTermStructure 问题描述 Piecewise** 分段收益率曲线的原理 Piecewise** 对象的构造 Fit ...

- QuantLib 金融计算——收益率曲线之构建曲线(3)

目录 QuantLib 金融计算--收益率曲线之构建曲线(3) 概述 估算期限结构的步骤 读取样本券数据 一些基本配置 配置 *Helper 对象 配置期限结构 估算期限结构 汇总结果 当前实现存在的 ...

- QuantLib 金融计算——收益率曲线之构建曲线(5)

目录 QuantLib 金融计算--收益率曲线之构建曲线(5) 概述 Nelson-Siegel 模型家族的成员 Nelson-Siegel 模型 Svensson 模型 修正 Svensson 模型 ...

- QuantLib 金融计算

我的微信:xuruilong100 <Implementing QuantLib>译后记 QuantLib 金融计算 QuantLib 入门 基本组件之 Date 类 基本组件之 Cale ...

- QuantLib 金融计算——自己动手封装 Python 接口(1)

目录 QuantLib 金融计算--自己动手封装 Python 接口(1) 概述 QuantLib 如何封装 Python 接口? 自己封装 Python 接口 封装 Array 和 Matrix 类 ...

- QuantLib 金融计算——自己动手封装 Python 接口(2)

目录 QuantLib 金融计算--自己动手封装 Python 接口(2) 概述 如何封装一项复杂功能? 寻找最小功能集合的策略 实践 估计期限结构参数 修改官方接口文件 下一步的计划 QuantLi ...

- QuantLib 金融计算——数学工具之插值

目录 QuantLib 金融计算--数学工具之插值 概述 一维插值方法 二维插值方法 如果未做特别说明,文中的程序都是 Python3 代码. QuantLib 金融计算--数学工具之插值 载入模块 ...

- QuantLib 金融计算——高级话题之模拟跳扩散过程

目录 QuantLib 金融计算--高级话题之模拟跳扩散过程 跳扩散过程 模拟算法 面临的问题 "脏"的方法 "干净"的方法 实现 示例 参考文献 如果未做特别 ...

随机推荐

- vertx 异步编程指南 step8-使用RxJava进行反应式编程

vertx 异步编程指南 step8-使用RxJava进行反应式编程 2018-04-23 13:15:32 zyydecsdn 阅读数 1212 收藏 更多 分类专栏: vertx 到目前为止 ...

- webapi 返回类型

参考 大神;https://www.cnblogs.com/landeanfen/p/5501487.html

- disable_function绕过--利用LD_PRELOAD

0x00 前言 有时候直接执行命令的函数被ban了,那么有几种思路可以bypass 1.使用php本身自带的能够调用外部程序的函数 2.使用第三方插件入(如imagick) 但是这两种无非就是利用ph ...

- android studio学习----构建(gradle )依赖时使用动态依赖的问题

今天在看Dan Lew大神的博客发现最新的文章就是 “Don't use dynamic versions for your dependencies” Everyone, please, to st ...

- 安装Python,输入pip命令报错———pip Fatal error in launcher: Unable to create process using

今天把Python的安装位置也从C盘剪切到了D盘, 然后修改了Path环境变量中对应的盘符:D:\Python27\;D:\Python27\Scripts; 不管是在哪个目录,Python可以执行了 ...

- Cloud Alert 实现告警智能降噪,成功规避告警风暴

# 前言 睿象云前段时间发表了一篇[< Zabbix 实现电话.邮件.微信告警通知的实践分享>](https://www.toutiao.com/i6734876723126469127/ ...

- 旅游景点信息API接口大全

1.分享数据:“http://www.shareapi.cn/docs/api/id/127”,免费,次数1000次 返回JSON示例 { "SceneryID":10224,/* ...

- Linux进程管理之top

关于Linux进程查看,前面讲解了ps命令,下面拉介绍另一个命令top ps:静态查看 top:动态查看 动态查看进程的状态 # top [root@wei ~]# top top - 18:38:4 ...

- Linux命令——lsmod

参考:8 LSMOD, RMMOD, MODPROBE, AND MODINFO COMMAND EXAMPLES IN LINUX Linux lsmod command 简介 lsmod显示(或“ ...

- nbu虚拟机恢复样例(之后补图)

9.2.1进入Backup,Archive,and Restore管理器 9.2.2选择客户端和策略类型 9.2.3选择恢复的虚拟机 9.2.4恢复虚拟机到不同目录 9.2.5更改虚拟机名称和存储 因 ...