Time Series_2_Multivariate_TBC!!!!

1. Cointegration

n×1 vector yt of time series is cointegrated if each series individually integrated in the order d (d = 1, nonstationary unit-root processes, i.e., random walks; d = 0, stationary process).

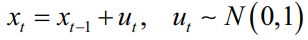

1.1 Simulation for Cointegration, based on Hamilton (1994)

#generate the two time series of length 1000

set.seed(20200229) #fix the random seed

N <- 100 #define length of simulation

x <- cumsum(rnorm(N)) #simulate a normal random walk

gamma <- 0.7 #set an initial parameter value

y <- gamma * x + rnorm(N) #simulate the cointegrating series

plot(x, col="black", type='l', lwd=2, ylab='simulated values')

lines(y,col="skyblue", lwd=2)

Both series are individually random walks.

In real world we don't know gamma, so need estimation based on raw data, running linear regression of one series on the other, i.e., Engle-Granger method of testing cointegration.

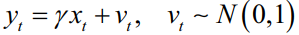

1.2 Statistical Tests (Augmented Dickey Fuller test)

install.packages('urca')

library('urca')

summary(ur.df(x,type="none"))

summary(ur.df(y,type="none"))

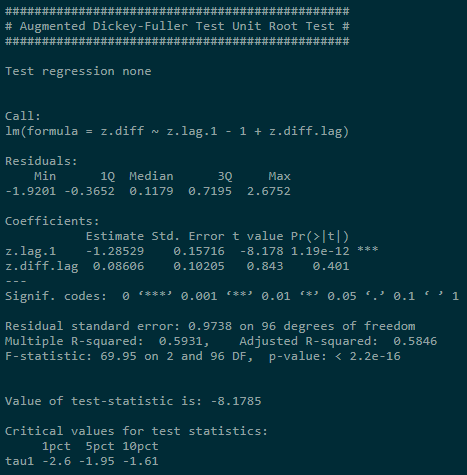

NULL: Unit root exists in the process

Reject NULL if test-statistic is smaller than critical value. Result shows test-statistic is larger than critical value at three usual sig.levels. We can't reject NULL.

Conclusion: Both series are individually unit root process.

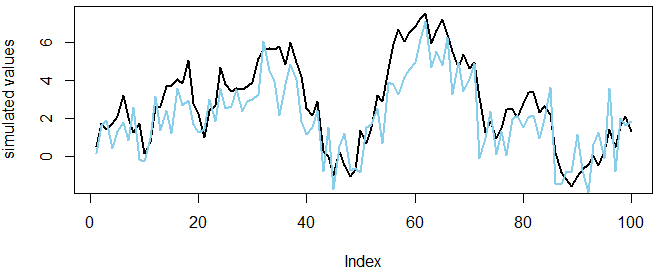

1.3 Linear Combination

z <- y - gamma * x

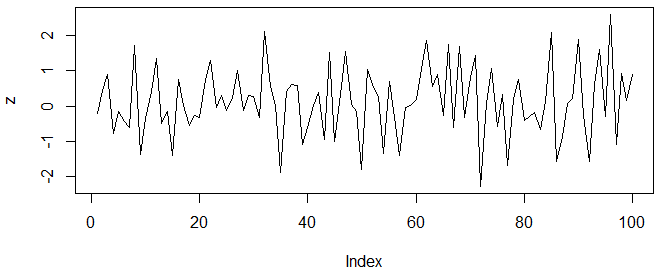

plot(z,type='l')

summary(ur.df(z,type="none"))

zt seems to be a white noise process and rejection of unit root if confirmed by ADF tests:

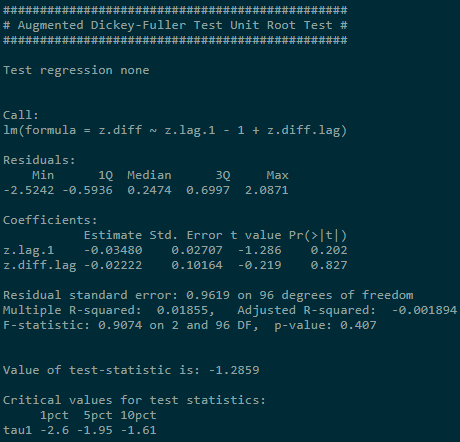

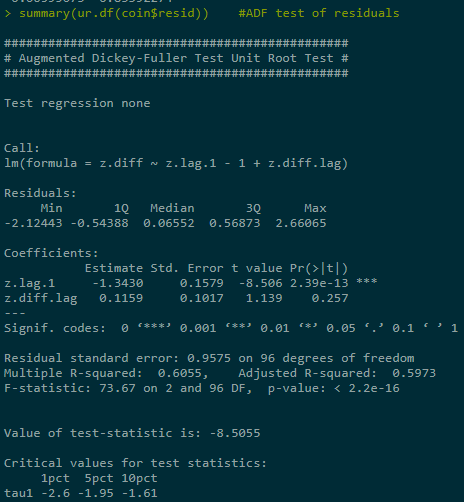

1.4 Estimate the Cointegrating Relationship using Engle-Granger method

Step 1: Run linear regression yt on xt (simple OLS estimation);

Step 2: Test residuals for the presence of a unit root.

coin <- lm(y ~ x -1) #regression without constant

coin$resid #obtain the residuals

summary(ur.df(coin$resid)) #ADF test of residuals

Reject NULL.

Pair trading (statistical arbitrage) exploits such cointegrating relationship, aiming to set up strategy based on the spread between two time series. If two series are cointegrated, we expect their stationary linear combination to revert to 0. By selling relatively expensive and buying cheaper one, wait for the reversion to make profit.

Intuition: Linear combination of time series (which form cointegrating relationship) is determined by underlying (long-term) economic forces, e.g., same industry companies may grow similarly; spot and forward price of financial product are bound together by no-arbitrage principle; FX rates of interlinked countries tend to move together.

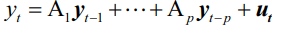

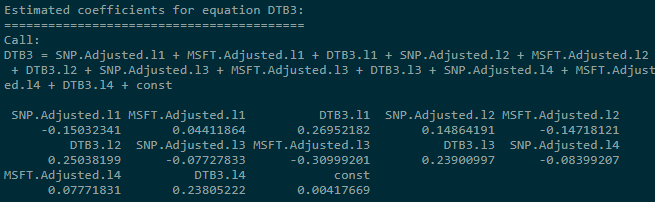

2. Vector Autoregressive Model

2.1 Theory Bgs

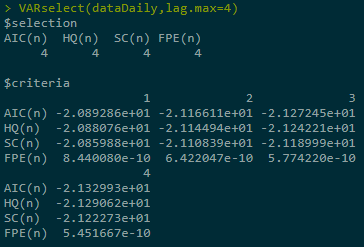

Ai are n×n coefficient matrices for all i = 1...p;

ut is a vector white noise process (assumes lack of auto correlation, while allow contemporaneous (同时发生的) correlation between components, i.e., ut has non-diagonal covariance matrix, meaning that contemporaneous dependencies aren't modeled) with positive definite covariance matrix. Thus we can use OLS to estimate equation by equation. (叫做 reduced form VAR models)

另一种叫做 structural VAR form model, SVAR models the contemporaneous effects among variables:

Where:

Disturbance terms are defined to be uncorrelated, thus are referred to as structural shocks.

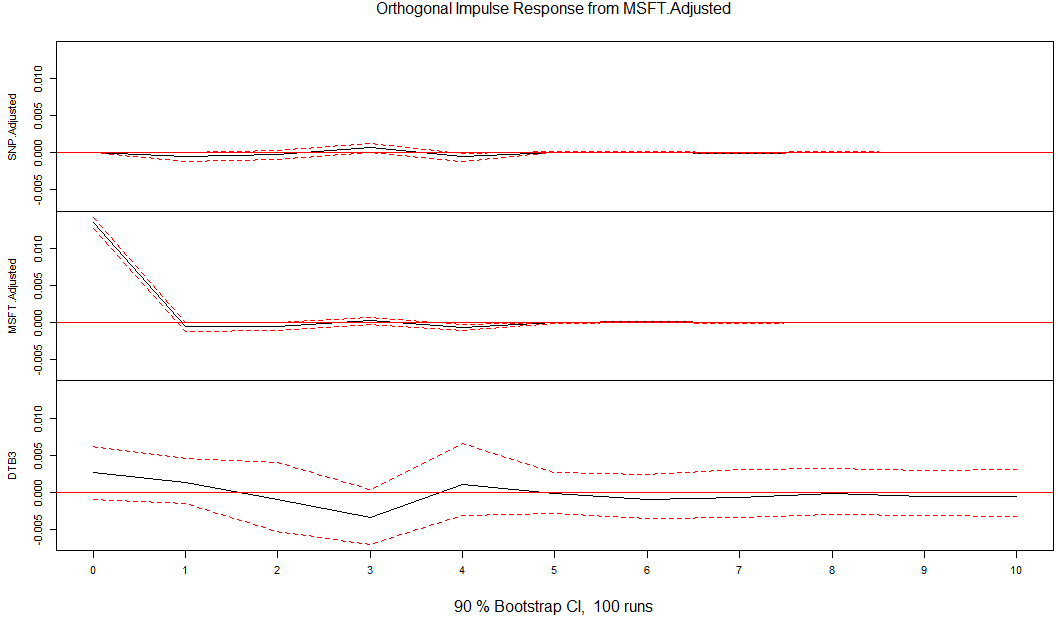

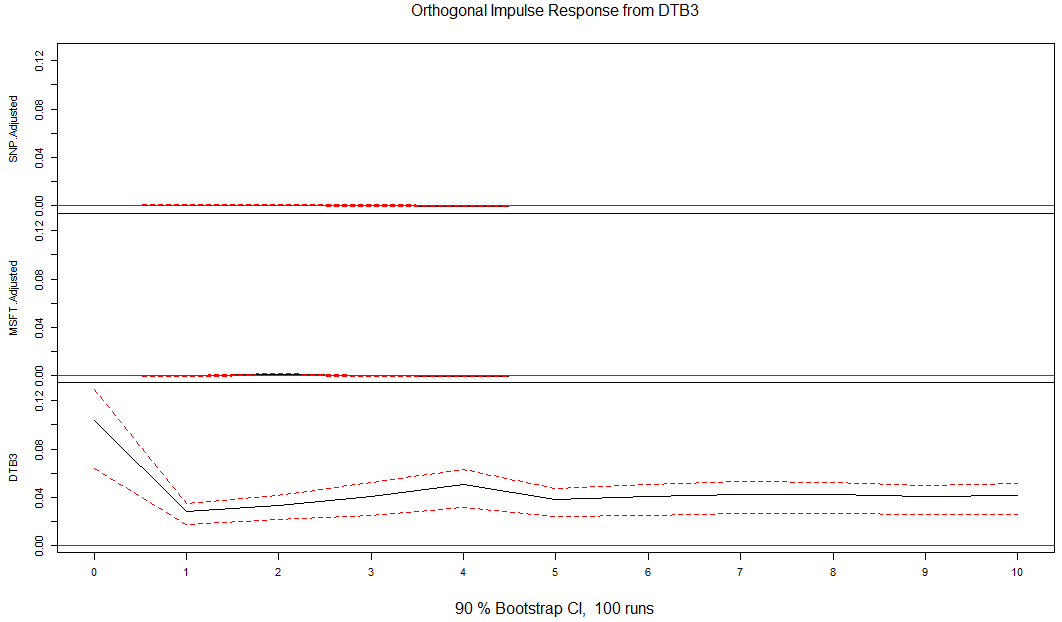

2.2 Three-component VAR model (equity return, stock index, US Treasury bond interest rates)

2.2.1 Task: Forecast stock market index by using additional variables and identify impluse responses.

Assume: There exists a hidden long-term relationship between these three components.

2.2.2 Process:

rm(list = ls()) #clear the whole workspace

install.packages('xts');library(xts)

install.packages('vars');library('vars')

install.packages('quantmod');library('quantmod')

getSymbols('SNP', from='2012-01-02', to='2020-02-29')

getSymbols('MSFT', from='2012-01-02', to='2020-02-29')

getSymbols('DTB3', src='FRED') #3-month T-Bill interest rates

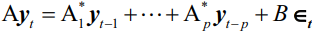

chartSeries(MSFT, theme=chartTheme('white'))

Cl(MSFT) #closing prices

Op(MSFT) #open prices

Hi(MSFT) #daily highest price

Lo(MSFT) #daily lowest price

ClCl(MSFT) #close-to-close daily return

Ad(MSFT) #daily adjusted closing price

Subset to obtain period of interests ,while the downloaded prices are supposed to be nonstationary series and should be transformed into stationary series:

#indexing time series data

DTB3.sub <- DTB3['2012-01-02/2020-02-29']

#Calculate returns from Adjusted log series

SNP.ret <- diff(log(Ad(SNP)))

MSFT.ret <- diff(log(Ad(MSFT)))

#replace NA values

DTB3.sub[is.na(DTB3.sub)] <- 0

DTB3.sub <- na.omit(DTB3.sub) # return with incomplete removed

# merge the three databases to get the same length

# innerjoin returns only rows in which one set have matching keys in the other

dataDaily <- na.omit(merge(SNP.ret,MSFT.ret,DTB3.sub), join='inner')

VAR modeling usually deals with lower frequency data, so transform data to monthly (or quarterly) frequency.

#obtain monthly data, package xts

SNP.M <- to.monthly(SNP.ret)$SNP.ret.Close

MSFT.M <- to.monthly(MSFT.ret)$MSFT.ret.Close

DTB3.M <- to.monthly(DTB3.sub)$DTB3.sub.Close

# allow a max of 4 lags

# choose the model with best(lowest Akaike Information Criterion value)

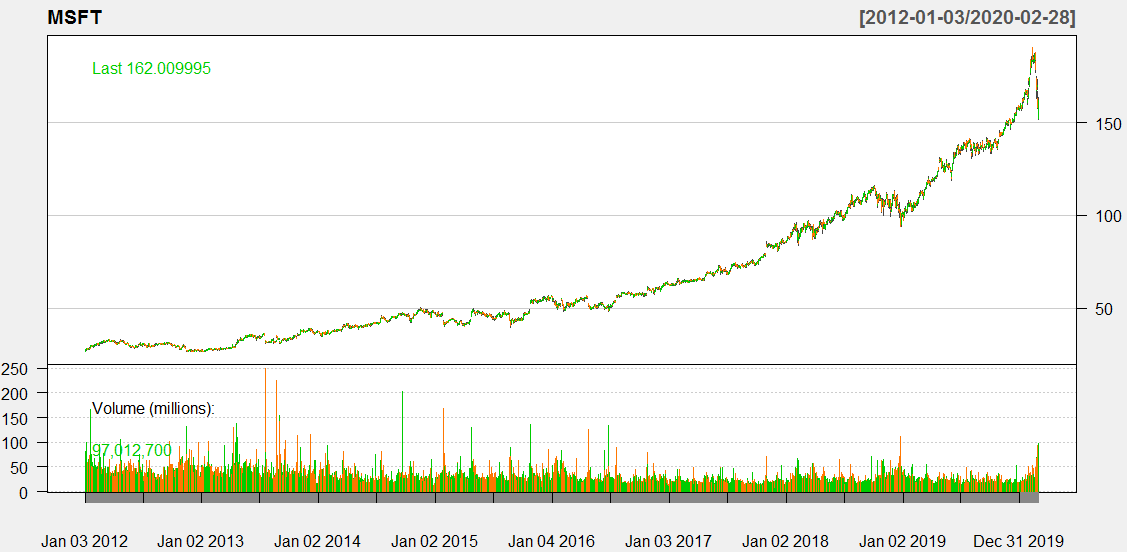

var1 <- VAR(dataDaily, lag.max=4, ic="AIC")

Or see multiple information criteria:

VARselect(dataDaily,lag.max=4)

summary(var1)

coef(var1) #concise summary of the estimated variables

residuals(var1) #list of residuals (of the corresponding ~lm)

fitted(var1) #list of fitted values

Phi(var1) #coefficient matrices of VMA representation

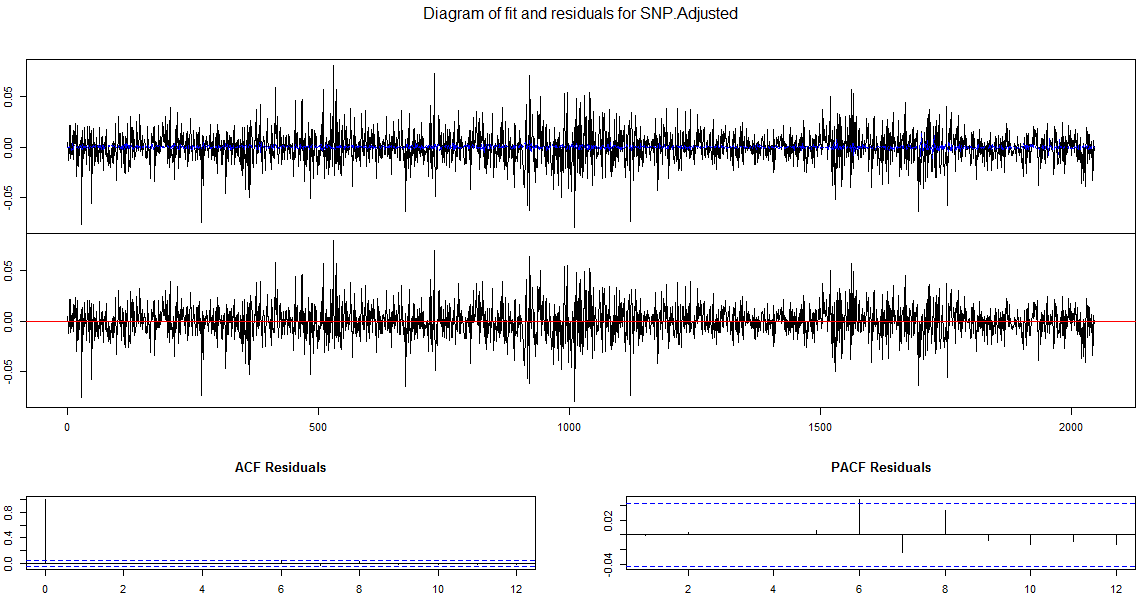

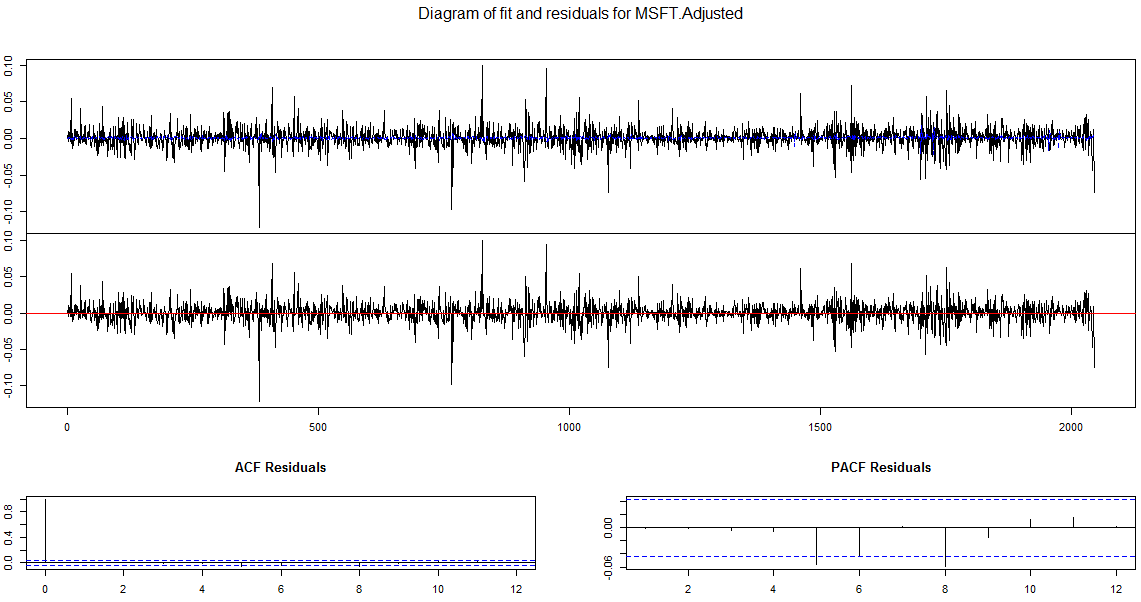

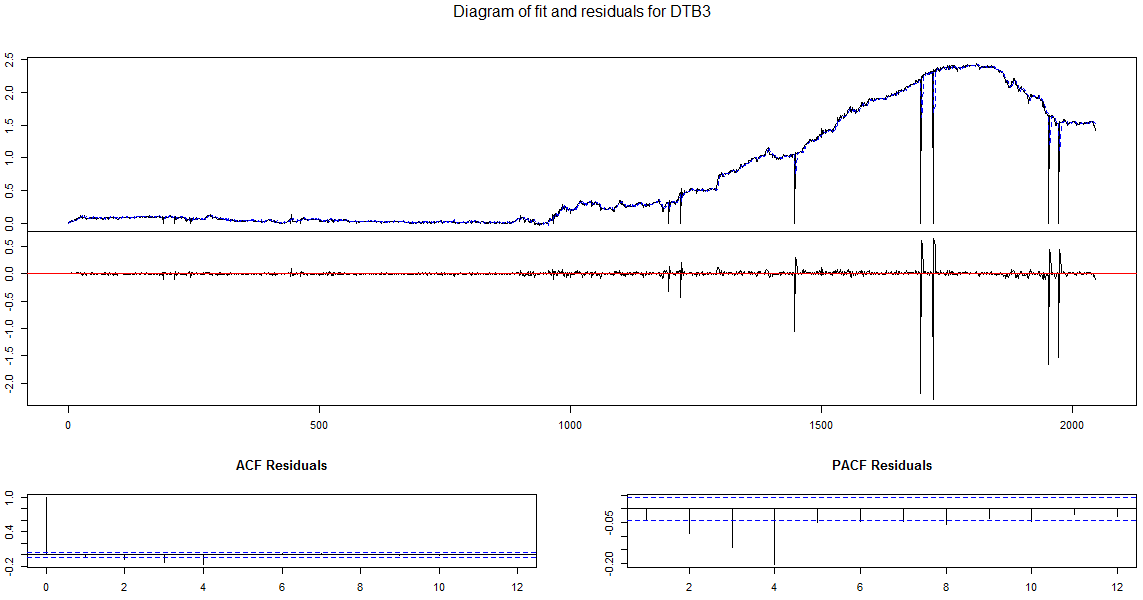

plot(var1, plot.type='multiple') #Diagram of fit and residuals for each variables

#confidence interval for bootstrapped error bands

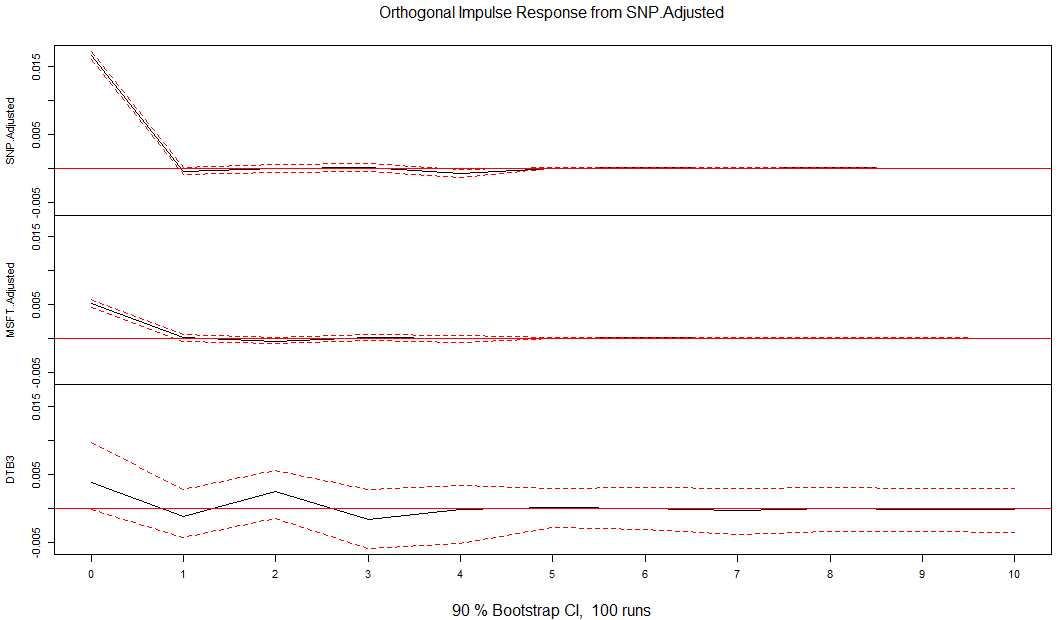

var.irf <- irf(var1, ci=0.9)

plot(var.irf)

Number of required restrictions for SVAR model is K(K-1)/2, so in our case is 3.

Time Series_2_Multivariate_TBC!!!!的更多相关文章

随机推荐

- elasticsearch ik解析器

ik解析器 1. ik解析器 The IK Analysis plugin integrates Lucene IK analyzer (http://code.google.com/p/i ...

- VS中编码格式的问题(待总结)

今天又遇到这样的事情了,VS中代码明明是正确的,却报某个变量未定义.百思不得解,前面增加了一个换行之后,竟然又神奇般的复原了. 最后确认是编码格式的问题,后来把有问题的那部分代码粘贴到微软的" ...

- 洛谷 P3371 【模板】单源最短路径(弱化版) && dijkstra模板

嗯... 题目链接:https://www.luogu.org/problem/P3371 没什么好说的,这是一个最短路的模板,这里用的dijkstra做的... 注意: 1.dijkstra和邻接表 ...

- vue.js ③

1.组件使用的细节点 H5编码中的规范是tr必须在tbody里所以不能直接套用<row></row>的写法,<ul>标签下支持<li>,select标签 ...

- javaweb项目中web.xml配置文件的/和/*的区别

1.拦截"/",可以实现现在很流行的REST风格.很多互联网类型的应用很喜欢这种风格的URL.为了实现REST风格,拦截了所有的请求.同时对*.js,*.jpg等静态文件的访问也就 ...

- 【Android多线程】异步信息处理机制

https://www.bilibili.com/video/av65170691?p=3 (本文为此视频听课笔记) 一.线程和线程之间为什么要进行通讯 各线程之间要传递数据 二.线程和线程之间如何通 ...

- 多数据库:SQLHelper

//=============================================================================== // This file is ba ...

- MSSQL2005数据库快照(SNAPSHOT)初探

定义:数据库快照是数据库(称为“源数据库”)的只读静态视图.在创建时,每个数据库快照在事务上都与源数据库一致.多个快照可以位于一个源数据库中,并且可以作为数据库始终驻留在同一服务器实例上.在创建数据库 ...

- mysql之魔鬼训练营

普通 + 中等 难度练习题 测试数据: --建表 --学生表 CREATE TABLE `Student`( `s_id` VARCHAR(20), `s_name` VARCHAR(20) NOT ...

- Spring学习(五)

自动装备 1.定义 自动装配(autowiring): 将某个Bean实例中所引用的其它的Bean自动注入到当前Bean实例中 自动装配就是指由Spring来自动地注入依赖对象,无需人工参与. 自动装 ...