Derivative Pricing_1_Black

1. Stock Option wih divends

1.1 Task A

1.1.1 Calculate a ECO on a stock.

/Ex-dividend dates in 3 and 6 months, each dividend is expected to be 1;

/P0 = 80, K = 80, σ = 0.25 per annum, rf = 0.07; T = 1;

1.1.2 Process and results:

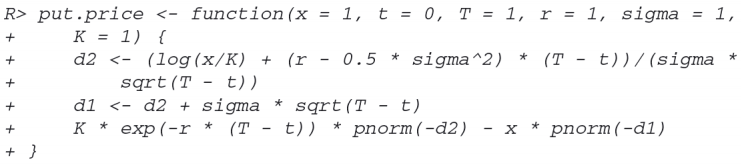

K <- 80

r <- 0.07

sigma <- 0.25

tau <- 1

# pv of expected dividends

d <- exp(-(tau/4) * r) + exp(-(tau/2) * r)

# stock price

S <- K - d

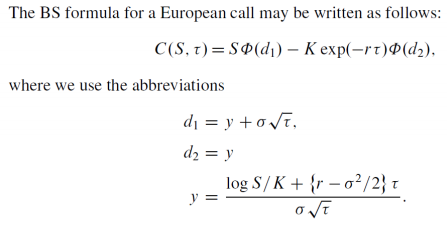

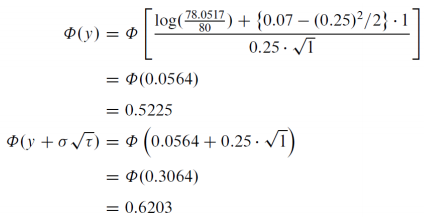

Deduct pv of dividends from S0 to arrive at purely random component of S0 which is 78.0517.

y <- (log(S/K) + (r - sigma^2 / 2) * tau) / (sigma * sqrt(tau))

cdfy <- pnorm(y)

cdfn <- pnorm(y + sigma * sqrt(tau))

# BS formula

C <- S * cdfn - (K * exp(-r * tau) * cdfy)

1.2 Task B

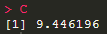

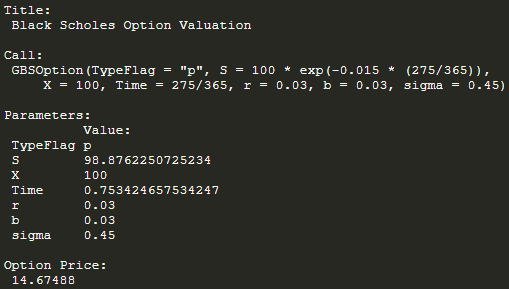

1.2.1 Calculate EPO using BSM model, assume that

/Continuously compounded dividend yield is 0.015;

/S0 = 100, K = 100, option expires in 275 days, volatility is 0.45;

/Continuously compounded rf = 0.03;

1.2.2 Process and results

# Adjust S0

GBSOption('p', 100 * exp(-0.015 * (275/365)), 100, 275/365, 0.03, 0.03, 0.45)

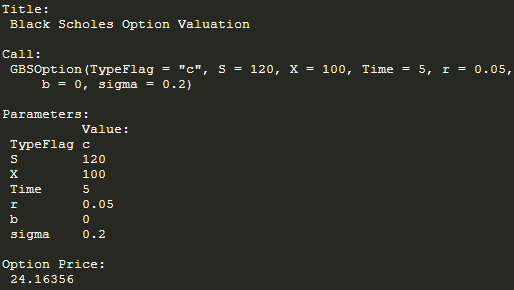

2. Black's Futures Option Model

2.1 Key parameter: S = F, b = 0;

2.2 Task: Need an option for an asset (futures price = 120), assume K = 100, T = 5, volatility = 20%, riskfree rate = 5%;

2.3 Process and results:

GBSOption('c', 120, 100, 5, 0.05, 0, 0.2)

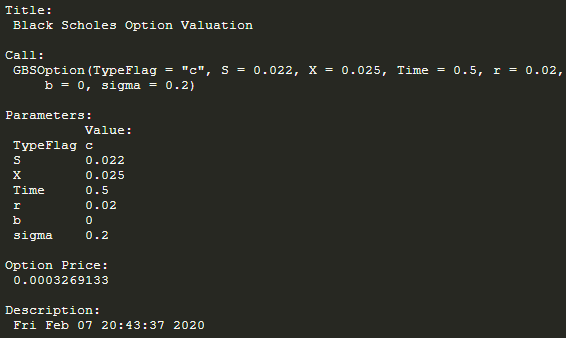

3. Pricing Cap Using Black

3.1 Key parameter: S = F(n-1), b = 0;

3.2 Notes:

Interest rate caps are interest rate derivatives, where holder receives positive payments throughout periods if interest rate exceeds certain level (strike price, K).

Interest rate floors the holder wins if interest rate below K.

3.3 Task:

Need to pay USD LIBOR for 6 months to Alex between May and Nov 2020, so use caplet avoid interest rate risk.

Assume: the caplet on LIBOR rate with 2.5% strike price (i.e., if LIBOR > 2.5%, one period payoff = 0.5 * max[3% - 2.5%, 0]);

LIBOR follows Brownian Motion with 20% volatility;

forward rate between May and Nov = 2.2%;

spot rate = 2%;

3.4 Process and results:

GBSOption('c', 0.022, 0.025, 0.5, 0.02, 0, 0.2)

3.5 Comments

3.5.1 Still need to multiply the time interval 0.5 on 0.0003269133 to get 0.0001634567, if unit is million USD, the final price of caplet will be 163USD;

3.5.2 Cap is sum of caplets !!! % LIBOR changes all the time, example above is just a single caplet calculation, below is whole method. Now assume that:

we need a cap that pays if LIBOR > 2.5% in first 3m, or if LIBOR > 2% in following 3m;

forward LIBOR rate in May~Aug is 2.1%, in Aug~Nov is 2.2%;

GBSOption('c', 0.021, 0.025, 0.25, 0.02, 0, 0.2)

GBSOption('c', 0.022, 0.02, 0.25, 0.02, 0, 0.2)

# we seperately get two prices, each of them with time interval 0.25, so final price of cap is:

0.25 * (3.743394e-05 + 0.002179862)

0.000554324

So final price of cap will be 554USD.

4. Drawing Binomial Trees for Stock Option

4.1 Key parameter: b = r;

4.2 Assume:

Stock P0 = 900, K = 950, r = 0.02, T = 3m, Volatility = 0.22

4.3 Process and results:

tree <- BinomialTreeOption(TypeFlag = 'ce', S = 900, X = 950, 1/4, 0.02, b = 0.02, sigma = 0.22, n = 3)

BinomialTreePlot(tree, dy = 1, xlab = 'Time steps', ylab = 'number of up steps', xlim = c(0, 4))

title(main = 'European Call Option')

4.4 Comment:

This is CRR Binomial model, which converges to Black. Black Pricing is as below:

Derivative Pricing_1_Black的更多相关文章

- Derivative of the softmax loss function

Back-propagation in a nerual network with a Softmax classifier, which uses the Softmax function: \[\ ...

- Derivative of Softmax Loss Function

Derivative of Softmax Loss Function A softmax classifier: \[ p_j = \frac{\exp{o_j}}{\sum_{k}\exp{o_k ...

- XVII Open Cup named after E.V. Pankratiev Stage 14, Grand Prix of Tatarstan, Sunday, April 2, 2017 Problem A. Arithmetic Derivative

题目:Problem A. Arithmetic DerivativeInput file: standard inputOutput file: standard inputTime limit: ...

- The Softmax function and its derivative

https://eli.thegreenplace.net/2016/the-softmax-function-and-its-derivative/ Eli Bendersky's website ...

- matlab 提示 Continuous sample time is not supported by discrete derivative 错误的解决办法

Simulink仿真的时候,出行错误提示:Continuous sample time is not supported by discrete derivative 中文意思是:连续采样时间不支持离 ...

- [PE484]Arithmetic Derivative

题意:对整数定义求导因子$'$:$p'=1,(ab)'=a'b+ab'$,求$\sum\limits_{i=2}^n(i,i')$ 这个求导定义得比较妙:$(p^e)'=ep^{e-1}$ 推一下就可 ...

- 【找规律】【DFS】XVII Open Cup named after E.V. Pankratiev Stage 14, Grand Prix of Tatarstan, Sunday, April 2, 2017 Problem A. Arithmetic Derivative

假设一个数有n个质因子a1,a2,..,an,那么n'=Σ(a1*a2*...*an)/ai. 打个表出来,发现一个数x,如果x'=Kx,那么x一定由K个“基础因子”组成. 这些基础因子是2^2,3^ ...

- 共变导数(Covariant Derivative)

原文链接 导数是指某一点的导数表示了某点上指定函数的变化率. 比如,要确定某物体的速度在某时刻的加速度,就取时间轴上下一时刻的一个微小增量,然后考察速度的增量和时间增量的比值.如果这个比值比较大,说明 ...

- 求导四则运算以及三角函数求导 Derivative formulas

对特定函数的求导. 1:sin(x) 对其进行求斜率.带入公式得:[ sin(x+Δx)- sin(x)]/Δx = [ sinx*cosΔx + cosx*sinΔx -sin x ]/ Δx = ...

随机推荐

- SQL注入--sqli-labs(1-4关)

Less_1 查库:select schema_name from information_schema.schemata 查表:select table_name from information_ ...

- Java 判断五子棋五子相连

#开始 最近在忙着做一个基于酷Q的QQ机器人,想到了做游戏,第一个想到的霸气点的游戏就是五子棋啊 ` _>` 因为没有图形界面的原因 所有核心就是判断是否在棋盘上出现了五个棋子连在一起的情况 ...

- Implementing Recurrent Neural Network from Scratch

Reading CSV file... Parsed 79171 sentences. Found 65376 unique words tokens. Using vocabulary size 8 ...

- 2.0.FastDFS单机模式综合版

Centos610系列配置 1.什么是FastDFS? FastDFS是一个开源的分布式文件系统,她对文件进行管理,功能包括:文件存储.文件同步.文件访问(文件上传.文件下载)等,解决了大容量存储和负 ...

- 「NOIP2018」赛道修建

传送门 Luogu 解题思路 一眼先二分(上界树的直径,下界最小边权),然后再考虑 \(\text{DP}\). 对于当前节点 \(u\),在它的所有儿子中分别返回一条匹配不完的长度最大的路径 \(M ...

- VBA 学习笔记 - 输入框

学习资料 https://www.yiibai.com/vba/vba_input_box.html 输入框 InputBox 函数说明 提示用户输入值.当输入值后,如果用户单击确定 按钮或按下键盘上 ...

- 通过命令创建Django项目

本人是使用window10操作系统进行讲解Django框架,Linux系统和windows版本几乎一致,可以自行学习就可以解决. 首先在系统上创建了虚拟环境,如果不会创建,可以根据这篇文章学习:htt ...

- vue-lazyload 的使用(vue图片懒加载)

github地址:https://github.com/hilongjw/vue-lazyload npm i vue-lazyload -S 或者 <script src="http ...

- ElasticSearch学习记录 - 命令示例

GET /searchfilmcomments/searchfilmcomments/_search { "query": { "match_all": {} ...

- org.apache.commons.dbcp.SQLNestedException: Cannot create PoolableConnectionFactory (Unknown database 'jdsc')

org.apache.commons.dbcp.SQLNestedException: Cannot create PoolableConnectionFactory (Unknown databas ...